You'll be able to normally get the money out to pay for charges other than training, but you’ll shell out federal revenue tax plus a ten% penalty to do so.

The compensation we get from advertisers won't influence the tips or assistance our editorial workforce supplies in our content or in any other case influence any of the editorial written content on Forbes Advisor. When we work flat out to provide accurate and up to date details that we expect you'll find applicable, Forbes Advisor would not and cannot assurance that any facts furnished is complete and helps make no representations or warranties in relationship thereto, nor into the precision or applicability thereof. Here's a listing of our companions who provide products that we have affiliate one-way links for.

The 529 plan has two important sorts: a pay as you go tuition strategy and an training price savings strategy. They Each individual serve distinct needs and present distinct investment decision procedures.

* Must be utilised primarily via the beneficiary for the duration of any on the yrs the beneficiary is enrolled at an qualified educational institution.

That gives your hard earned money much more time for you to increase. In addition, options normally provide age-dependent expense portfolios, which assist equilibrium your investments depending on how near your child is to college, potentially decreasing your danger.

When you have leftover cash in a 529 system, which include in the event the beneficiary gets a major scholarship or chooses never to go to college, you have several alternatives. You'll be able to change the beneficiary to another qualifying relative, hold The existing beneficiary in the event that they commit to pursue higher instruction afterwards or attend graduate school, or expend to $ten,000 to repay the first beneficiary's or their siblings' federal or personal college student loans.

Account holders can pick which investments (usually mutual cash) they intend to make. How These investments execute establishes the amount the account value grows after a while.

The price of bigger schooling won't come low-priced, meaning It truly is a smart idea to start conserving when Youngsters are Studying their ABCs — not whilst They are finding out for his or her SATs.

Speak to the program's trustee or administrator to find out the program's contribution limit. Contributions made to a QTP are not deductible.

Some 529 programs also provide practical purchaser-helpful options Which may be vital that you you, like check here an internet platform wherever family and friends can make a contribution to your son or daughter’s prepare. Consider the benefits and extras accessible from your point out’s approach.

At NerdWallet, our information goes through a rigorous editorial overview system. We have now this sort of self-assurance in our precise and valuable content that we Enable outdoors experts inspect our function.

Any time you’re comparing 529 plans and underlying investments, also Verify the whole once-a-year payment you’ll be billed, like not just management and condition service fees but The prices of your investment portfolios themselves.

Extra Tricks for 529 Ideas Just like other kinds of investing, the sooner you start, the greater. Using a 529 prepare, your hard earned money may have far more time for you to improve and compound the sooner It really is opened and funded.

For those who do that, nevertheless, you should Consider the amount of income is still left inside the program for the second (or third) youngster the moment it’s been tapped by an earlier kid.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Andrea Barber Then & Now!

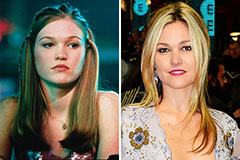

Andrea Barber Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!